In the absence of just over a month for the presentation of the new strategic plan of Telefónicathe company continues to work on the plan to disin in non -strategic markets as part of an extension review of the company undertaken from the landing of Marc Murtra In the Presidency.

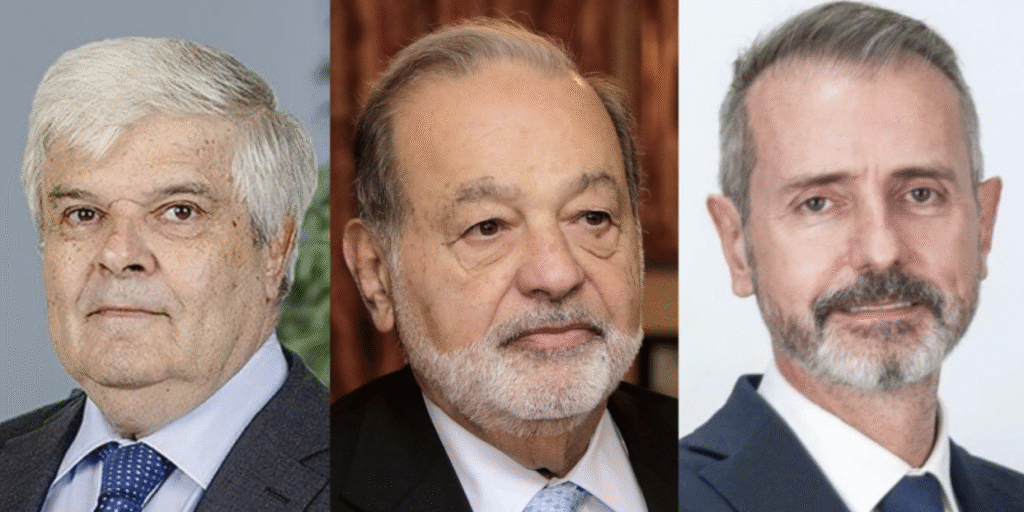

The last budding movement is a Possible sale of Telefónica Chile. According to the information published by Bloombergthe group of Carlos Slim América Mobe and the Chilean Entel work to present an offer to acquire the filial of Telefónica.

With this operation, the mobile phone business would be in the hands of MOBILE AND ENTEL America I would be interested in the fixed telephony part. In this way, Chile could be the next subsidiary that Telefónica sold in Latin America, a region that is reconfiguring the panorama of its telecommunications market by the Spanish company.

From the different operations announced by the company, Telefónica has recently received the authorization for the sale of its Uruguayan subsidiary for 370 million euros. Thus, he joined the sale of Argentina Argentina for about 1,190 million euros closed at the time of the firm and its business in Peru to Integra Internacional, which assumed a debt of 1,240 million euros in the agreement.

Now the group is waiting to receive authorization for the sale of Colombia – change of about 370 million euros – and Ecuador – by approximately 330 million euros – to Millicom.

In this way, Marc Murtra’s change of strategy has reconfigured the map of telecommunications in Latin America in just a few months, reducing its exhibition in markets considered non -strategic and more volatile, generating a concentration process in the sector that must now reconfigure its leadership.

Plans

The company’s plans go through focus on its four key markets (Brazil, Spain, the United Kingdom and Germany) and the sale of Latin America’s businesses will not only help the company reduce its leverage, but also to Improve the quality of your free cash flowwhich is positively seen by the qualification agencies.

In this sense, in August Fitch reaffirmed his rating about the company highlighting the “great progress in reducing its exposure to Latin America outside Brazil.” Thus, they explained that “the company is gaining margin in its medium -term qualification supported by the organic improvement of free cash flow and asset sales income.”